You may wonder about the differences between CPAs and accountants. Both play different roles in managing money. Choosing the right one for individual tax preparation services in Brownwood can make a big difference in your finances. CPAs are accountants, but not all accountants are CPAs. CPAs pass a tough exam and meet strict licensing rules. They offer expert advice in many financial matters. Accountants handle basic financial tasks. You turn to them for bookkeeping or payroll. When choosing, think about your needs. Are you facing a complex tax situation, or do you need general financial help? Choose with care. Making smart choices can lead to peace of mind. Understanding what each offers helps you decide. By learning these differences, you feel empowered in your financial decisions. Start making informed choices today. Find the right professional for your needs and gain control over your financial future.

CPAs: Defined and Detailed

Certified Public Accountants, or CPAs, are recognized financial experts. They have passed the CPA exam, which tests knowledge in auditing, business law, regulation, and more. CPAs also meet state-specific licensing requirements. Their role extends beyond tax preparation. They offer auditing services, strategic financial planning, and consulting. Their expertise can guide businesses through financial regulations and complex fiscal decisions.

Accountants: An Overview

Accountants manage everyday financial operations. They perform tasks like bookkeeping, maintaining financial records, and preparing basic tax returns. While they may not hold a CPA license, their role is crucial in managing personal or small business finances. Their services are often more accessible and less costly than those of a CPA.

Comparing Roles

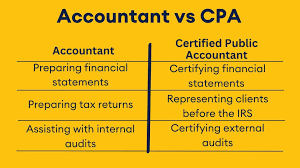

Understanding the differences can help you choose the right financial professional. Here is a table to summarize the key distinctions between CPAs and accountants:

| Aspect | CPA | Accountant |

| Certification | Requires CPA exam and state license | No certification needed |

| Services Offered | Auditing, tax preparation, financial consulting | Bookkeeping, tax preparation, financial record maintenance |

| Cost | Generally higher | Generally lower |

| Expertise Level | High, with specialized knowledge | Basic to intermediate |

Choosing the Right Professional

Deciding between a CPA and an accountant depends on your needs. If you require in-depth financial analysis or face complex tax issues, a CPA might be the better option. However, for standard bookkeeping or straightforward tax returns, an accountant can be more cost-effective.

Consider the complexity of your financial situation. When making a choice, reflect on the level of expertise you need, as well as your budget constraints.

Additional Resources

For further guidance, the American Institute of CPAs provides resources on CPA roles and requirements. Additionally, theInternal Revenue Service offers insights into tax-related questions and services provided by accountants and CPAs.

Final Thoughts

Understanding these differences is key in managing your finances effectively. By knowing what each professional offers, you make informed decisions that align with your financial goals. Whether you go with a CPA or an accountant, the right choice leads to peace of mind and effective financial management.